It's not often that a company beats estimates and raises guidance

only for the stock to be promptly sold-off by investors. Clearly, in the

case of Home Depot (NYSE: HD ) , the market is pricing in some future macroeconomic uncertainty.

The company's recent earnings were excellent, and gave no cause for the sell-off. The most likely explanation is that investors are starting to fear the future impact of rising rates on the housing market. So is this a buying opportunity in the stock, or is the market right to be concerned?

Home Depot P/E Ratio trailing-12 months data by YCharts

Firstly, while rising rates will affect housing affordability, according to historical data, buying a house via a mortgage is still affordable. For example, here is the NAHB and Wells Fargo (NYSE: WFC ) housing-opportunity index.

The company's recent earnings were excellent, and gave no cause for the sell-off. The most likely explanation is that investors are starting to fear the future impact of rising rates on the housing market. So is this a buying opportunity in the stock, or is the market right to be concerned?

Home Depot hits a home run

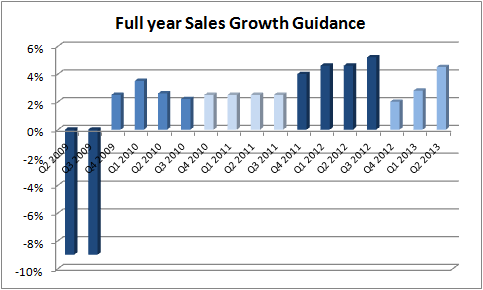

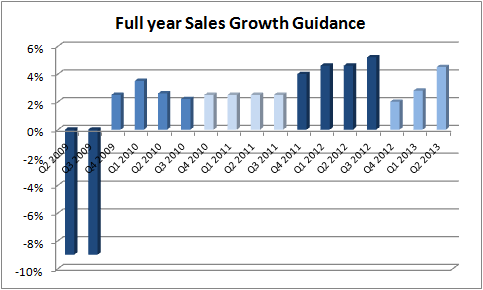

In the second quarter, Home Depot recorded its

first double-digit sales increase in over 13 years, and raised full-year

earnings and revenue guidance. Indeed, the latter event is becoming a

pretty good benchmark for improving conditions within the US housing

market.

source: company reports

Clearly the US housing market is doing well this year, but recent rate rises and a fall in new home sales data for July has

highlighted the potential dangers in housing. Conditions may well be

fine now, but if this turns out to be the peak then buying into

home-improvement stores could prove to be a mistake.

Moreover, the valuations on Home Depot and Lowe's (NYSE: LOW ) suggest that both companies need an ongoing housing recovery in order to move higher from here.

Home Depot P/E Ratio trailing-12 months data by YCharts

If you put these arguments together, it is easy to

start beginning the case that Home Depot's prospects have peaked and the

stock could fall from here. Is it really that simple?

Why it's not time to panic

There are four main reasons why investors shouldn't give up just yet.

Firstly, while rising rates will affect housing affordability, according to historical data, buying a house via a mortgage is still affordable. For example, here is the NAHB and Wells Fargo (NYSE: WFC ) housing-opportunity index.

Source: national association of home builders

It is an index that Wells Fargo investors should follow closely, since the bank runs over 20% of the US mortgage market.

The index may well have peaked, but continued job gains and increases

in average household wealth will help to mitigate the effects of rising

rates on the index.

Indeed, Wells Fargo needs an improvement in new

mortgage origination because higher rates are slowing refinancing

activity. In response, the bank is taking measures to boost lending, but

the ultimate guide to its fortunes will be how the housing market fares

in future.

Secondly, homeowner vacancy rates remain low and close to historical norms.

Source: united states census of the bureau

This is a pretty good indication that the housing

recovery has legs, because it implies that there isn't an oversupply of

properties on the market. The figures are nowhere near the kind of

vacancy rates reached from 2006 through 2011.

The third reason is that the economy doesn't just

turn on a dime. The US economy is growing (albeit moderately), and

investment in housing isn't just a function of interest rates. In fact,

rates tend to rise when the economy is getting better, and banks tend to

start loosening credit standards when the economy improves. Moreover,

job gains will add new potential home buyers to the marketplace; all of

which are good for the housing market.

The final reason is that the Federal Reserve is

watching! For all the talk of tapering quantitative easing, the truth is

that Ben Bernanke always outlines that tapering is contingent upon the

economy improving. Since housing is a key part of the economy, it is

reasonable to expect that the Federal Reserve will do what it takes to

keep mortgage rates low.

The bottom line

The market is right to fear some affect from

interest rate rises, but the housing market has too much momentum behind

it to fall away anytime soon. Investors in Home Depot and Lowe's should

look forward to ongoing improvements in end- market demand.

While Home-Depot is more of a pure-play on housing, Lowe's also has upside from its internal restructuring.

The latter is trying to reset its sales lines with a view to increasing

inventory turnover. Lowe's is executing well on its plans, but its

usually easier to do such things when end-markets remain favorable. In

other words, both companies are still likely to see their prospects

dictated by the housing market.

With the market seemingly determined (in the short

term) to price in some future weakness in Home Depot, it looks like a

good opportunity to pick up some stock.